Shady pensions: “We are financing our own doomsday through our pensions”

In a series of articles, CBS WIRE investigates the future of pension companies that invest in fossil fuels, weapons and tobacco. (GIF: Emil Friis Ernst / CBS WIRE)

Two CBS alumni have started the company Matter Pension, which invests people’s pensions sustainably. “When asked if they are interested in financing global warming, most people say no. But most pensions give them no choice,” says co-founder Emil Stigsgaard Fuglsang. An expert in pensions at CBS explains that pension companies are playing a major role in the green transition and have made large investments over the past few years.

Multiple times while interviewing CBS alumni Emil Stigsgaard Fuglsang, co-founder of Matter Pension, I catch myself thinking: “I really need to start involving myself in my pension and how it’s invested, although I probably won’t leave the job market until I’m 74 years old.”

Emil Stigsgaard Fuglsang explains that five percent of all stocks are based on fossil fuels, coal and gas, and that currently, deep underground reserves hold enough fuel to generate five to seven times the amount of CO2 we may emit if we want to keep the global temperature from rising more than two degrees Celsius.

“So what happens if 80 percent of that has to stay underground? The dilemma is that the stocks and companies would drop in value, but if we continue extracting oil, coal and gas, the temperature will keep rising,” he says and continues:

“Whether we extract the oil or not, it’s a bad business case. Either we lose our money, or we finance our own doomsday through our pensions.”

And this scenario prompted him and Niels Fibæk-Jensen, who both studied for bachelor and master degrees in International Business and Politics at CBS, to start Matter Pension. In short, Matter Pension pledges that your pensions savings isn’t invested in fossil fuels, weapons and tobacco and that you avoid investing money in companies that have breached human rights or been involved corruption, among other things.

“The average person doesn’t agree with how their pension is invested, and when asked if they are interested in financing global warming, most people say no. But most pensions give them no choice,” says Emil Stigsgaard Fuglsang.

Niels Fibæk -Jensen and Emil Stigsgaard Fuglsang from Matter Pension pledge to invest their customers’ pension savings sustainably. (Photo: Matter Pension)

This is the case for PhD Fellow at CBS Joachim Delventhal, who has discovered that his pension company, JØP, invests his money in arms dealers, oil producers and tobacco manufacturers. And due to Danish law and collective agreements he is forced to remain with JØP.

“My pension is intended to secure my future, but if the investments made actually ruin the future, where is the sense in that?” asks Joachim Delventhal, PhD fellow at the Department of Organization at CBS in this article:

Denmark’s pensions could fund a huge chunk of the Paris Agreement

DKK 4,121,000,000,000. This staggering amount of money is what Denmark’s workforce contributed to pensions in 2017, according to Statistics Denmark.

According to Emil Stigsgaard Fuglsang, DKK 10 trillion is what is needed, every year until 2030 to meet the Paris Agreement and keep the average global temperature from rising more than 1.5 degrees Celsius. Likewise, the investment gap for the UN’s Sustainable Development Goals for 2030 is DKK 17 trillion – annually.

“The pension companies could play a massive role if that money was invested in more companies and projects that promote sustainability, and less in fossil fuel economy. Danish pension funds are committing more and more to sustainable investments, but as long as they also keep backing the fossil fuel industry, they are somehow betting against themselves – and our collective future,” says Emil Stigsgaard Fuglsang.

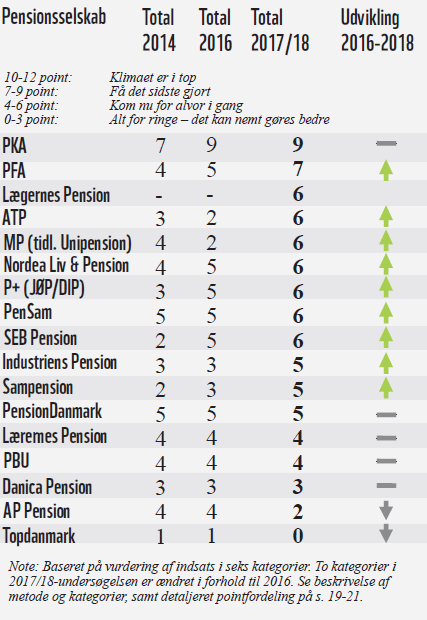

In April 2018, the Danish branch of the World Wildlife Fund (WWF), issued a report ranking 17 Danish pension companies based on points awarded for their climate actions. If a company has 10 to 12 points, the climate is top priority, whereas a company with only 0 to 3 points is doing close to nothing.

The Danish branch of WWF has ranked 17 of the largest pension companies in Denmark and given them points according to their focus on the climate. Is your pension company on the list? (Illustration: WWF)

Professor Jesper Rangvid, who works at the Pension Research Centre (PeRCent) at the Department of Finance at CBS, explains that pension companies are heavily influenced by the climate debate. Consequently, they are investing more money in so-called alternative investments.

“We have seen a significant increase in the number of investments in off-shore windmill projects, green infrastructure and other alternative investments. It is correct to say that the total amount of these investments comprises a smaller share, but it has significantly increased in recent years. The pension companies are taking this very seriously,” he says.

Jesper Rangvid agrees that pension companies play an “important part” in propelling both society and the planet in a greener direction. But one thing weighs higher than the climate.

“Pension companies have the money to invest in really long-term investments – such as windmills – which are central for the green transition. At the same time, it’s important to remember that the primary role of the pension companies is to provide retirees with as high a pension income as possible, with a balanced risk. That’s their main objective and it’s the law. But aiming for a high return on pension savings, can be achieved in many ways,” he says and continues:

“It’s important to say that you can’t invest all your money in windmills, as this won’t make your pension grow in a balanced way. You have to spread investments across different areas to ensure good and stable returns.”

What are sustainable investments worth?

As Jesper Rangvid just pointed out, the main aim of the pension companies is to make their members’ pensions grow. So, are sustainable investments good investments?

Emil Stigsgaard Fuglsang accesses the S&P Dow Jones Indices website, where the 500 Environmental & Socially Responsible Index measures the performance of 500 selected securities that meet environment and social responsibility criteria over time.

“If you compare these securities to the 500 securities in the parent index, the socially responsible ones are performing a little better, actually. This, among many different studies, indicates that investing sustainably doesn’t harm returns,” he says, pointing out that with a pension at Matter Pension, you can avoid the amount of CO2 equivalent to 27 cars a year.

And investing money in long-term green projects actually makes sense for the pension companies, explains Jesper Rangvid.

“If we look at windmills again, they are often suitable investments for pension companies. Often, they are long-term projects and produce a stable income for many, perhaps 30 or so, years. This is why pension companies are investing more and more money in green projects like this,” he says.

However, he also points out that if all investors withdrew their investments from, for example, oil companies, also known as a ‘sin stock’, oil could become a good investment for others.

“Let’s say that oil costs $70 a barrel and will keep that price for the next 30 years. This is not a prediction but to illustrate. In this case, it will constitute a stable income flow. If the stock today falls in price because investors shy oil stocks, you still get that flow of income if you buy the stock. But now you can it for a lower price. So, the cheaper the stock, the better a return it generates,” he says.

On the question of whether it is realistic for politicians to ask pension companies to stop investing in oil, Jesper Rangvid replies:

“It’s impossible to answer if we’ll get there. But it’s important to say that this is the direction we are taking. And it’s up to the members as well to voice their views on the investments made by their pension companies, and discuss how their returns will be affected if they step away from investing in for example oil,” he says.

“Action speaks louder than words”

Joachim Delventhal has spoken his mind at JØP’s general assembly, but he felt the company was unwilling to do anything radical about its investments.

He then considered changing his pension company and investing his pension through Matter. At first, this seemed possible through an exemption via the Ministry for Higher Science and Education, but his request was rejected.

“Joachim is not alone in this. A lot of employees in Denmark can’t change pension companies. But members can change the course of their pension company,” says Emil Stigsgaard Fuglsang.

There’s no case out there in which investors have stopped an oil company from extracting oil

Emil Stigsgaard Fuglsang

He describes how MP Pension gave up investing in fossil fuels at the request of its members, and advises that others do the same if they are not satisfied with their pension investments.

“You may be met with the argument that your pension company has active ownership of the company through the stocks. But here it’s important to tell them that is nonsense. There’s no case out there in which investors have stopped an oil company from extracting oil. Action speaks louder than words,” says Emil Stigsgaard Fuglsang.

Jesper Rangvid also says that members’ voices must be taken into account in the pension companies. Having said that, though, the larger the membership, the more diverse the opinions.

“Some argue against investing in weapons manufacturers, but yet other members think investing in weapons is defendable as they can protect us against terrorists. These are ethical dilemmas that the pension companies and their members will have to discuss,” he says.

In the end, Emil Stigsgaard Fuglsang thinks it is time to confront the trade unions and revisit how collective agreements are made. Though this is no easy task, it could be the best way to let individual employees decide what pension company they want and how their money should be invested.

“Employees are forced into certain pension companies through their trade unions, and if the trade unions actually have an opinion on how their members’ money is invested, I would be happy. But that’s rarely the case. That is why it’s a huge problem,” he says and continues:

“If the trade unions don’t start prioritizing sustainability in the choice of pension for their members, the collective agreements must be changed so that individuals can pick their own pension companies. It’s not that easy, but if you want to have a say in how your paycheck is invested, that’s the way to go.”

Thanks for another interesting article. For all, who are interested in knowing more about their own pension or even want to challenge their pension, have look at this: https://www.information.dk/densorteliste?lst_srsbox