Denmark has fallen behind on responsible finance – new minor aims to change that

(Illustration: Shutterstock)

The other Nordic countries are ahead of Denmark in the context of financial responsibility, including responsible and sustainable investments, according to CBS researcher Kristjan Jespersen. Investment funds do not know where to start or end, but a new minor at CBS aims to give candidates the necessary tools to change Denmark’s position in a fast-moving world facing climate changes and pandemics.

A large pension fund was hoping to hire an Environmental, Social and Governance (ESG) risk assessment officer. There was just one problem. They could not find one candidate with all the right qualifications. A person who could both mine and structure large amounts of data on everything from carbon emissions to sustainable investments and interpret that data, as Kristjan Jespersen, Assistant Professor at the Department of Management, Society and Communication, explains.

“So they hired two people. Instead, we need candidates who can do both, and that’s what the new minor will help to offer,” he says about the minor in Environmental, Social, Governance (ESG): Metrics, Reporting and Sustainable Investments ( Minor in ESG ) that will be available from the fall semester.

In short, the new minor consists of three courses that include teaching on how companies can report on sustainability, how such measurements can be evaluated, and how they are connected to sustainable investments and risk. Ultimately, helping students to understand what is and what is not a good deal. Something the financial organizations in Denmark are challenged with at the moment, Kristjan Jespersen explains.

“The investment funds’ responsibility is to manage risk and sustainability. But they are challenged, because how do they calculate their own and other’s emissions, and are the metrics accurate? There’s so much noise out there, different metrics, different measurement tools and strategies. And people are asking them to be more active in this field, but the investors are stressing out, they don’t know what to do,” he says.

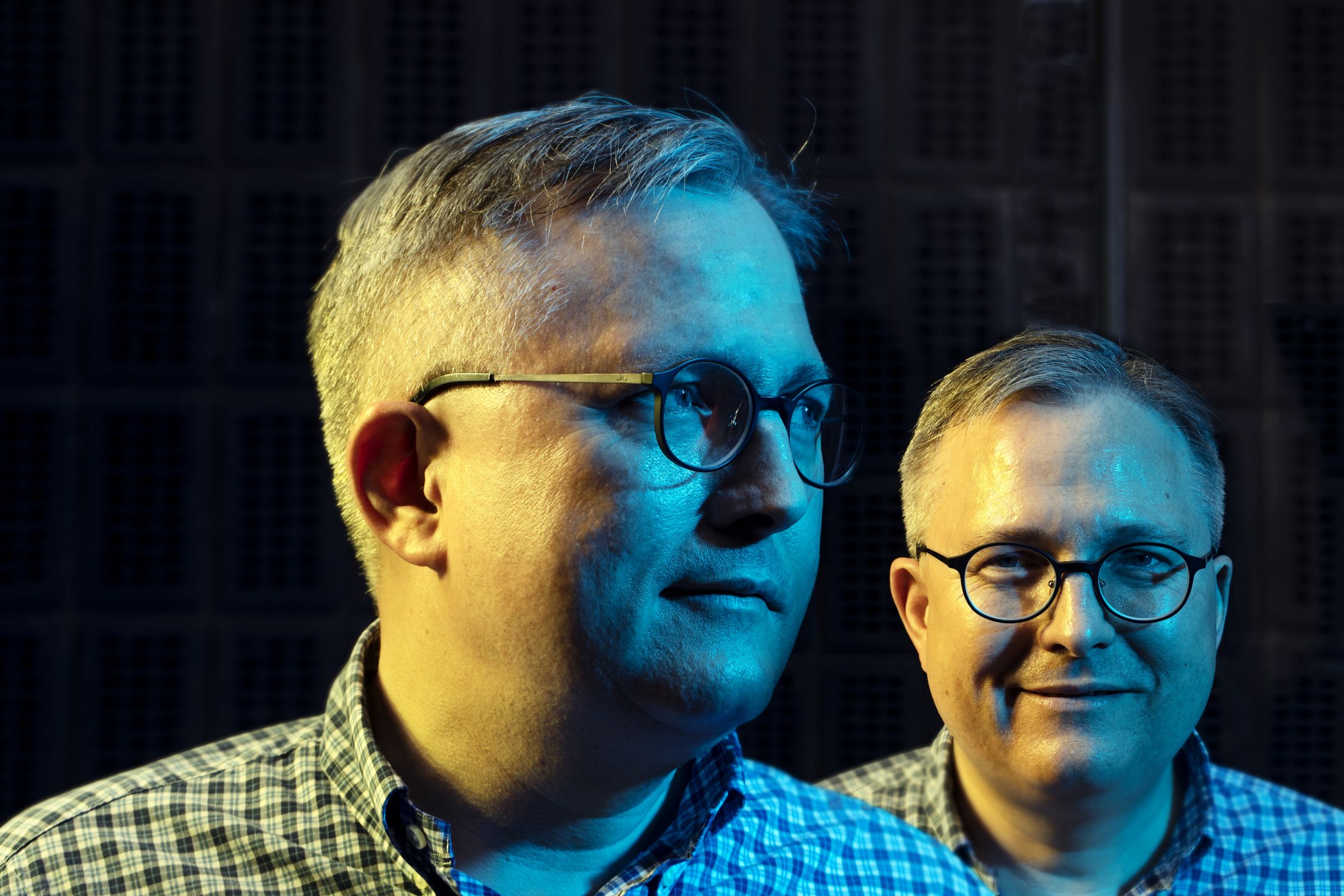

(Illustration: Shutterstock)

Kristjan Jespersen has been working on the idea for this minor for about 2.5 years, but it was not until he began getting calls from pension funds asking him for advice on sustainability and responsibility in connection with the palm oil industry, that he started to appreciate the challenges they were facing.

“In my opinion, Denmark has lost competitiveness to its Nordic peers in terms of responsible finance and we are not innovative enough in sustainable metrics. We have fallen behind, and that’s never a good position to be in,” he says, arguing that from a financial perspective, it is harder to handle risk when you do not know the mechanism behind it, how it is measured or even have the skills to deal with it.

“The current COVID-19 crisis has taught us to act quickly. The same should be true for developing greater competencies in sustainable finance. We cannot delay. These are skills that are of strategic importance and cannot be limited or not taught,” he says and continues:

“With this minor, students will be able to see both sides of the story. They will understand the necessity of ESG and will know how to work with it,” he says.

Collaboration with financial organizations

Kristjan Jespersen explains that during the minor, students will meet representatives from various financial organizations who will co-teach on specific cases and issues that the sector is facing. Furthermore, in collaboration with financial organizations, Kristjan Jespersen will incorporate specific topics that concern the industry.

“We must have relevance for the industry. At the master’s level, it involves making sure that the skillsets taught equip the students for the job market,” says Kristjan Jespersen and continues:

“For the students, it’s about being able to understand, manage and interpret risk, and apply these skills as a strategic opportunity for companies. In a world that’s ever more complex and transparent, having graduates who understand how to tradeoff from complexity and how it corresponds to the company in a focused way is hyper important.”

The current COVID-19 crisis has taught us to act quickly. The same should be true for developing greater competencies in sustainable finance

Kristjan Jespersen

Kristjan Jespersen explains that students who take the minor will be equipped with tools of relevance in many different contexts. For example, students who land jobs as supply chain managers will find decoding deforestation policies and unravelling their products’ CO2 emissions easier, and future HR managers will have the tools to compile diversity and inclusion strategies.

“The skills taught on this minor stretch across the board and can be used in any field touching on any of the three aspects of ESG,” says Kristjan Jespersen.

Comments