CBS’ celebrity: He is rocking the financial world

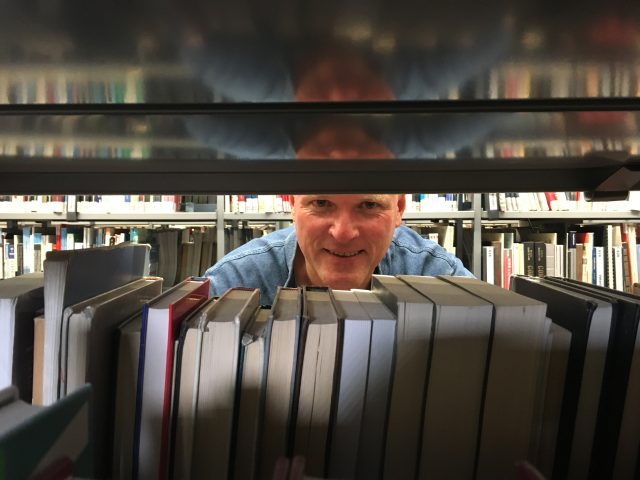

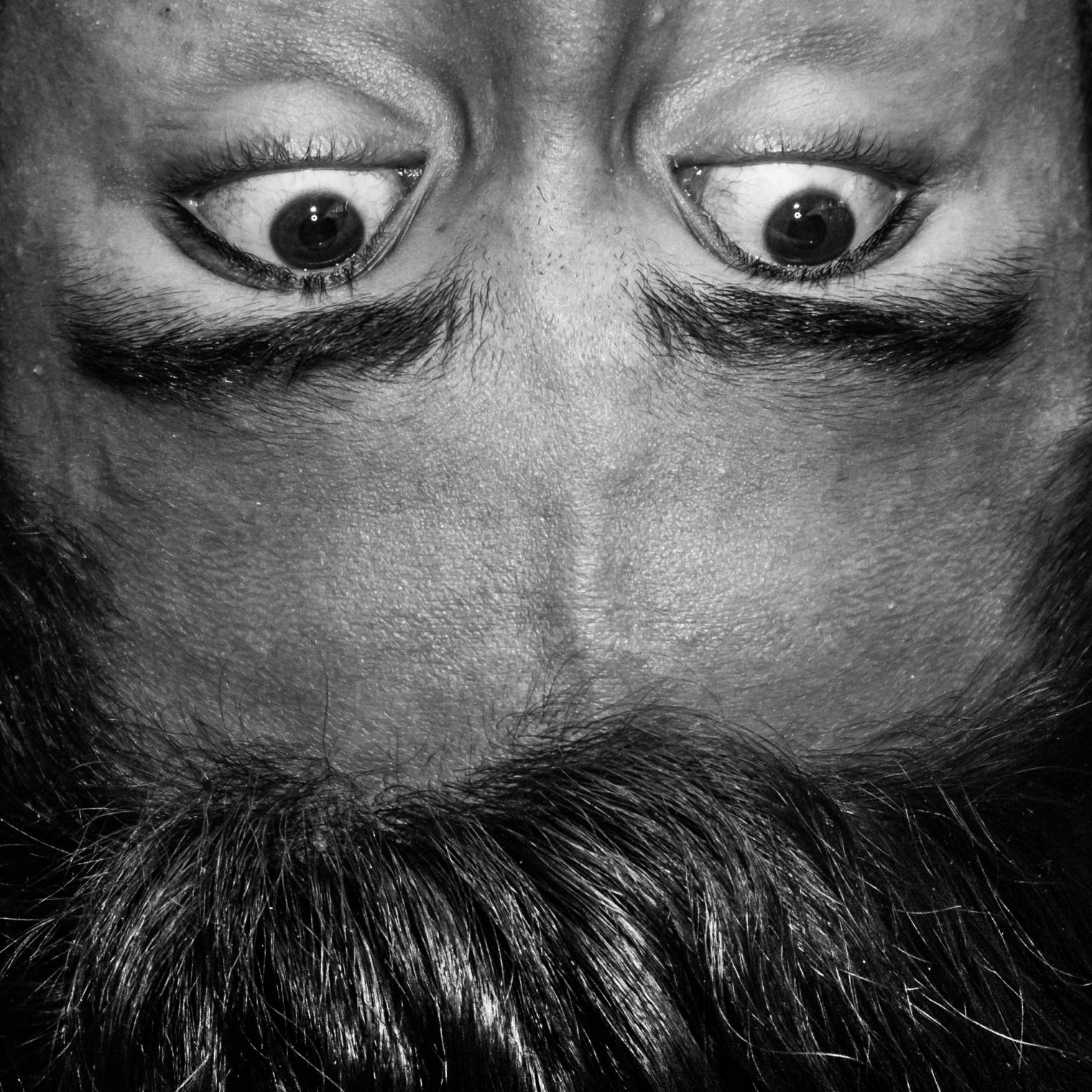

Lasse Heje Pedersen, Professor at the Center for Financial Friction, is one of the most influential researchers in the world. (Photo: Anne M. Lykkegaard & Mette Koors)

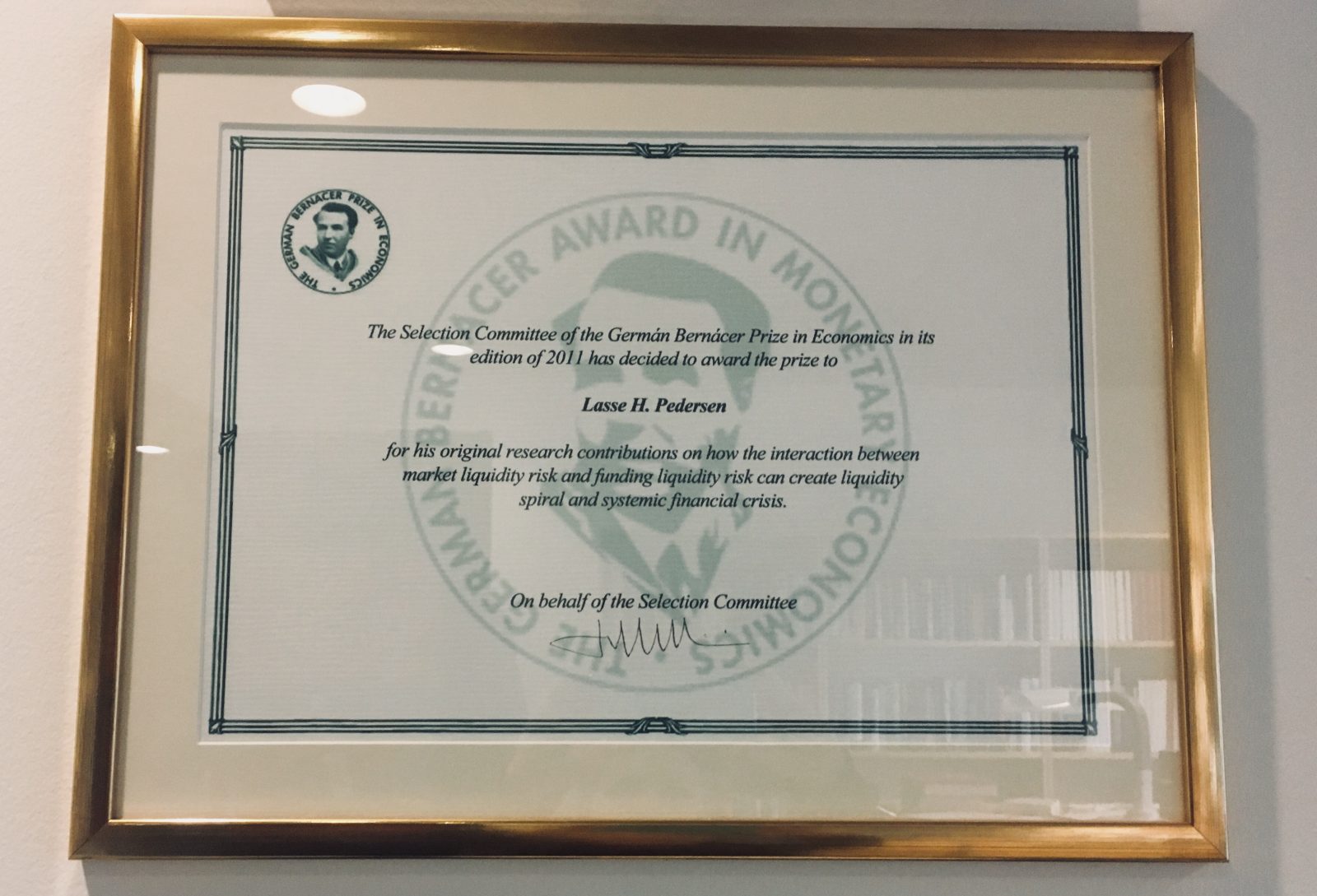

Strangers want to take selfies with Lasse Heje Pedersen when he shows up at conferences, numerous awards for his research on liquidity are hanging on the wall in his office at CBS, and now, he just appeared on a list of the 3,000 most influential researchers in the world - for the second time. CBS WIRE met with the popular professor.

Sports have Messi, Caroline Wozniacki, and Michael Jordan. The film industry has Audrey Hepburn, Leonardo DiCaprio, and Lucy Liu. But research has its celebrities as well. One of them does his daily routine at CBS.

Lasse Heje Pedersen, Professor at the Center for Financial Friction at CBS, has his walls tapestried in gold framed and gold-plated awards for his research on liquidity risk and financial frictions. And with good reason.

Lasse Heje Pedersen’s research has received great recognition within the financial world, and he is now among the world’s most influential researchers, as Clarivate Analytics has placed him on their list of 2017’s most highly cited researchers – for the second time.

“The first time, I actually didn’t know about it right away. It was Lars Nondal from the CBS Library who sent me an email with a link to the list. How he figured it out, I don’t know. But I’m thrilled that my research is of use to others, and this is what the citations show,” says Lasse Heje Pedersen.

Sometimes I find mathematical models truly beautiful

Lasse Heje Pedersen

Being famous as a researcher, does not exactly equal paparazzi following you, or weekly stories about one’s life, but it does include selfies with fans once in a while.

“You are not getting recognized in the street, not at all. But if I’m giving a talk at a conference, people will often have read some of my articles, and – since you ask — it happens that people want to take a selfie with me. That’s kind of funny,” he says.

Beautiful models

Maybe it’s a little difficult to get a grip of Lasse Heje Pedersen’s popularity within research. He also appears on the list with the most downloaded research papers within finance and economics. Lasse Heje Pedersen’s name comes up as number four on the list of authors for the most downloaded papers, and number 1 for the most downloaded paper in the past 60 days.

“It means a lot to me that people see the value of my research and that they make use of it. The lists of the most cited – or most downloaded – papers reflect academic impact, but the numbers are not the full story,” he says and continues:

“Sometimes it is easier to have impact with a relatively simple paper. At the same time, I am sometimes more proud of a more mathematically complex result, even if it is not cited as much, and it is often the personal discussions that mean the most – for example, when another researcher that I really respect tells me that they learned something valuable from my research, that makes me really happy.”

And it is the complexity of mathematics that makes it fun.

“I really enjoy learning something new when I get some calculations to `fall into place’ or look at some data in a new way. The feeling of being illuminated is exciting. I mean, sometimes it’s difficult, and your calculations aren’t going anywhere, but then, suddenly, it all makes sense,” he says and adds:

“Sometimes I find mathematical models truly beautiful.”

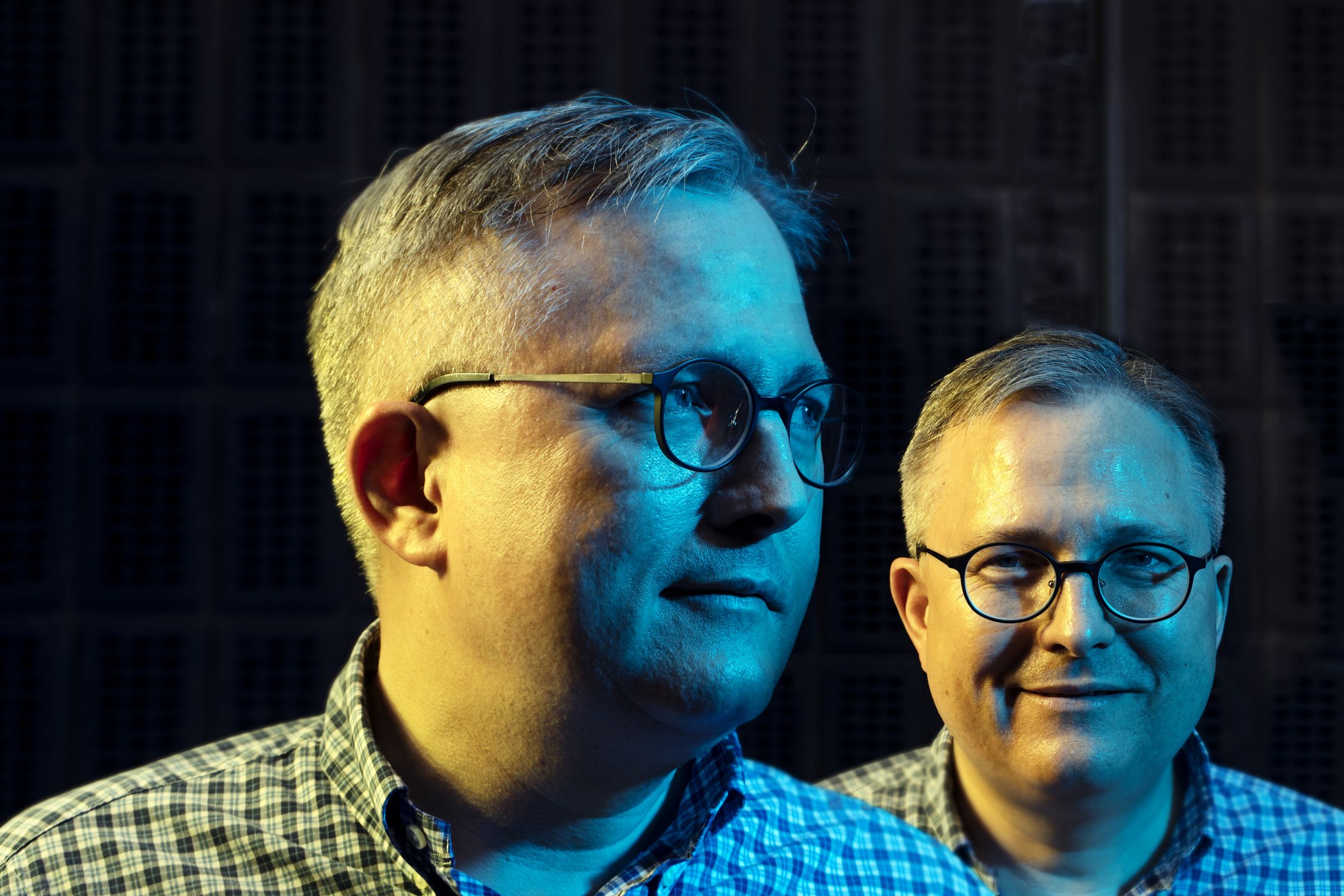

The walls of Lasse Heje Pedersen’s office are covered in awards and prizes. (Photo: Anne M. Lykkegaatd)

But it does not always have to be complex and difficult to understand for the unhallowed.

Lasse Heje Pedersen’s latest paper is about “Deep Value”. In this paper, he investigates what happens when stocks are sold exceptionally cheap. And to explain this, Lasse Heje Pedersen uses an analogy from a clothing store.

“If you have a 50 percent sale at the clothing store, you usually have a lot of customers coming to buy a piece of the good deal. But sometimes the reverse happens if a stock goes on “sale” – when stocks become cheap people suddenly want to sell them, and buyers are not running to catch the bargain as they would in the clothing store. I wanted to figure out why,” he says and continues:

“My co-authors and I test three different theories, and we look at prices, earnings, news stories, selling pressure, trading costs, and many other variables for thousands of stocks around the world, but, to sum it all up, the fall in price and trading behavior can be explained with an overreaction in the market. This paper is hopefully useful for investors, banks, pension funds, and to some extent the public may also have an interest in knowing how the stock market works,” he says.

Big awards – big pressure

Before Lasse Heje Pedersen came to CBS, he studied and worked in the U.S. for 14 years. To begin with, he studied at Stanford University, and later worked at New York University, where he was promoted to a position as tenured professor. A position which gives you a life-time position at the university.

And it was during his time in America that he started to receive several prizes.

“My motivation to do research comes from within, but of course the recognition gives an extra encouragement. Plus, being awarded various prizes and listed among the most cited researchers, gets you invited to all kinds of events and helps build up a network,” he says.

At Lasse Heje Pedersen’s office, an award with a gold frame is hanging on the wall. It is the Bernácer Prize in Economics, which was given to him in 2011. This award is handed out each year to the best European researcher within economics, and even though Lasse Heje Pedersen is proud of the award, it has also caused a great deal of pressure.

“Some of my colleagues in the US kept telling me that they were sure, I would receive this award, which created some amount of pressure. I wasn’t that interested in focusing on awards, I just wanted my research to be interesting and to solve some real-world problems. So, actually getting it removed the pressure,” he says.

With a tenured position at New York University, it could seem that Lasse Heje Pedersen had everything going for him in America , but he ended up quitting it to come back to Denmark and start working at CBS in 2011.

An enviable model

Right now, Lasse Heje Pedersen is working on a lot of projects, including some that he cannot talk about “otherwise I would have to kill you afterwards,” he says jokingly.

But they all have one thing in common. They seek to solve a specific problem within the finance world. Which leads to the question; is there a specific model or theory that has solved a problem and that you wished you had come up with?

The question hangs in the air for quite some time before Lasse Heje Pedersen raises his eyes from the floor.

“When I began research as a PhD student, I marveled at the people who made the groundbreaking finance models in the 1970s such as the Black-Scholes-Merton model. It seemed like a “golden age” when finance theory was, to some extent, being derived from scratch. Fortunately, there are still many interesting research questions waiting for an answer,” he says.

It happens that people want to take a selfie with me

Lasse Heje Pedersen

The Black-Scholes-Merton model is, according to the website Investopedia, one of the most important concepts in modern financial theory. It was developed in 1973 by Fisher Black, Robert Merton and Myron Scholes and is still widely used to determine fair prices for options.

But not everything revolves around research, stock prices, and conferences in Lasse Heje Pedersen’s life. In fact, he likes to use his spare time on something completely different.

“I love to play tennis. As much as I can. And then I also paddle board at the lake Furesø. I really enjoy being on the water, and I go out there even in the winter. It’s a nice change of pace to my work where I sit down a lot,” he says.

Comments