CBS researcher: Here’s what to do if you don’t want your business to end up like Lehman Brothers or Blockbuster

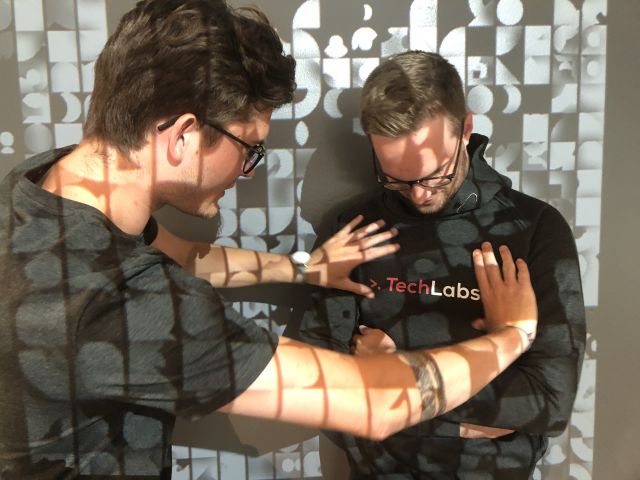

During Dorthe Thorning Mejlhede's PhD she has investigated how businesses react to innovation and disruption. (Photo: Anne M. Lykkegaard)

Lehman Brothers and Blockbuster were both solid businesses in the 2000s. Still, they faced unexpected and shocking collapses. Why? CBS researcher Dorthe Thorning Mejlhede has investigated how disruption and innovation operate as close cousins, and can destroy a business or make it future proof. Also, she explains why she has grown skeptical of innovation, all things considered.

2008 was an ill-fated year. The financial crisis, ignited by a real-estate crash, was full on, and the global financial community was trying its best to escape the avalanche of consequences the crisis caused. This included the American bank Lehman Brothers.

But, as is generally known, the bank that began as a small general store in Montgomery, Alabama, in 1884, did not make it to the other side. On September 15 2008, Lehman Brothers filed for bankruptcy. With $639 billion in assets and $619 billion in debt, Lehman’s bankruptcy filing was the largest in history, according to Investopedia.

The bankruptcy resulted in hundreds of employees, mostly dressed in business suits, leaving the bank’s global offices with bankers boxes in their hands.

Blockbuster faced a similar fate. In 1989, new Blockbuster stores were opening at the rate of one every 17 hours, and by 2004, The Washington Post estimated there were over 9,000 outlets in America alone. But then Netflix, founded in 1997, came into play.

In 2000, in an article in Forbes Magazine, Netflix’s founder, Reed Hastings, proposed joining forces with Blockbuster’s CEO, John Antioco, and his team. Netflix could run Blockbuster’s brand online, and Antioco’s firm would promote Netflix in its stores.

We all know what happened next. In 2010, Blockbuster bit the dust, and today Netflix is worth $ 157.3 billion.

“If you believe that you can keep a company healthy just by doing the same things but better, then your business will collapse, sooner or later,” explains Dorthe Thorning Mejlhede, who holds a PhD degree from the Department of Management, Politics and Philosophy at CBS, and continues:

“For example, banks are today turning their IT production into an agile setup in order to increase efficiency and reduce costs. This may seem a natural thing for banks to do. However, this is the equivalent of ‘doing the same but better’ and does not increase financial sustainability in the long run. On the contrary, this may very well be the same as directing the company towards sudden unexpected events like the collapse of Blockbuster and Lehman Brothers.”

Dorthe Mejlhede Thorning has just defended her PhD, in which she focuses on disruption and innovation based on a case study in the financial industry. More specifically, she investigates how executives and managers can keep their businesses financially sustainable and avoid disruptive events.

Based on her findings, she has developed a series of models and theories, one of which she has turned into a learning platform for executives, teams and individuals, and which she terms ‘the tool-dropping workshop’. A necessary maneuver that supports businesses’ survival in the long run, she claims.

Drop your tools and get radical

When Dorthe Thorning Mejlhede talks about tools in a business context, she means anything from mail culture to management styles and business models. And since any tool has been based on our ideas about the world, the ideas need to be dropped.

“Since the world is constantly changing, we must be able to challenge and gradually change these ideas and perceptions in order to create new tools, which can lead us to new solutions that can sustain the business,” she says.

The well-known saying; disrupt yourself before others do, is somewhat in line with my findings

Dorthe Thorning Mejlhede

Dorthe Thorning Mejlhede gives an example from the banking sector and explains that today, banks are threatened by low interest rates, heavy and expensive regulations, cybercrime, money laundering, the Silicon Valley tech giants’ payments solutions, and customers’ declining confidence. Still, they seem to keep picking the tools they know.

“Nevertheless, the industry has a strong belief that this should be tackled through efficiency, cost reduction, and laying off employees. Danske Bank recently demonstrated the latter and just announced that it plans to say goodbye to 2,000 employees,” she says and continues:

“Engaging in tool-dropping workshops on a continuous basis will turn it into a habit to spark thorough reflections on yourself and your business’ tools and behind them ideas about the world that you very well may consider changing. This will set you free to create new tools and thus new solutions, perhaps even radical new solutions.”

The tool-dropping workshop, Dorthe Thorning Mejlhede explains, is a kind of pre-innovation process for managers, who are considering whether innovation is needed. So, when executives recognize changes ahead, and if they choose to react to those challenges, they can propel themselves forward. In other cases, businesses are pushed into unknown territory.

“The well-known saying; disrupt yourself before others do, is somewhat in line with my findings. However, the challenge is how to do so,” she says.

One means of paving the way for innovation and avoiding having your business disrupted is through open dialogue. And for it to happen, the businesses’ top management have to stop taking the world they know for granted, argues Dorthe Thorning Mejlhede.

“Instead, they must engage with and listen to employees, friends, families and everyone who can help them challenge their world view, join the dots and paint a big global picture,” she says.

Burn that trash down

While working with and studying innovation and leadership, Dorthe Thorning Mejlhede came to a rather interesting conclusion. Because even though we can thank innovation for the internet, financial infrastructure and convenient payment solutions, Dorthe Thorning Mejlhede now sees innovation in a new light.

“Today, innovation is viewed exclusively as good and something that can maintain businesses and the public institutions. But innovation has also given us many questionable inventions and given rise to new structures and ways of exploiting resources that work contrary to the original aim,” she says.

In general, she is more skeptical about the phenomenon because, as she puts it, “innovations are maturing into what we take for granted. Huge banks are solid, and large wealthy companies like Blockbuster cannot go bankrupt.”

“While we are focusing on the matured innovation that has now grown so familiar that we cannot imagine the world without it, new innovations are evolving in the shadow of the old,” she says.

When innovation – or disruption, depending on how you view it – dawns on the horizon, there are several ways of coping with it, and sometimes Dorthe Thorning Mejlhede thinks Hella Joof, a Danish actor and member of the previous Disruption Council, had a point when she said: “Burn that trash down.”

“In order to keep a company financially sustainable, you have to continuously develop your business. And maybe it’s easier to create something new if you burn down the old legacy and the ingrained views of the world,” she says and continues:

“Just think about it. If we start reflecting on what a bank is and what it should be, we might come up with something quite different from what we have right now. What we need is banking – not necessarily the banks, we know today. And you can say the same about Blockbuster. It should have sold its shares and come up with something entirely new instead when it had the chance,” she says with a tongue-in-cheek smile.

Comments