Shady pensions: Trade unions warn against the freedom to pick your own pension company – but times may change

In a series of articles, CBS WIRE investigates the future of pension companies that invest in fossil fuels, weapons and tobacco. (GIF: Emil Friis Ernst / CBS WIRE)

In our third article about pension companies and sustainability, we talk to three trade unions about their choices of pension companies. According to them, members risk having their pension savings commercially utilized if they are free to pick their own pension companies. However, two trade unions are open to freedom of choice regarding pension companies if their members request it.

Today, members of trade unions often don’t have the option of picking a pension company. And that’s problematic, if you ask Emil Stigsgaard Fuglsang, co-founder of Matter Pension (see fact box). According to him, this lack of choice could mean that members invest in fossil fuels, tobacco and weapons, against their will.

“Employees are forced to join certain pension companies through their trade unions, and if the trade unions actually have an opinion on how their members’ money is invested, I would be happy. But that’s rarely the case, which is why it’s a huge problem,” says Emil Stigsgaard Fuglsang and continues:

“If the trade unions don’t start prioritizing sustainability when choosing pensions for their members, the collective agreements must be changed so that individuals can pick their own pension companies. It’s not that easy, but if you want a say in how your paycheck is invested, that’s the way to go.”

CBS WIRE has asked three trade unions, DJØF, the Danish Association of Masters and PhDs (Dansk Magisterforening) and Kommunikation og Sprog, about the pension companies they have selected and whether they are ready to change the collective agreements so that members can choose their own pension companies with mainly sustainable and responsible investment portfolios.

The three trade unions argue that giving their members freedom of choice could lead to commercial utilization of members’ pension savings, and both public and private employees risk being rejected by pension companies for health reasons.

“The benefits of today’s solution must be taken into account. As you cannot choose the pension company yourself, the pension company must accept you as a member of the pension scheme regardless of your health. You don’t have to submit a health declaration, whereas if you apply to a pension scheme individually, you can be rejected,” says Per Lindegaard Hjorth, Chairperson of Kommunikation og Sprog and continues:

“Therefore, the quickest way forward for responsibility and sustainability in pension investments is not through the freedom to choose pension companies, but through dialogue between members and unions on the one hand, and the pension companies on the other hand. So, for the time being, we are not considering enabling our members to choose their own pension companies. However, should our members wish to do so, of course, we would listen.”

Camilla Gregersen, Chairperson of the Danish Association of Masters and PhDs (DM), agrees. She is not interested in changing the collective agreements, as she believes it “would undermine the successful collective pension system principal if the members were to choose between competing pension funds.”

“The Danish labor market pension system is based on a collective approach where there is no competition between the different funds. Instead, each collective pension fund includes everyone, and all members make their contributions and receive significantly higher payouts and significantly better coverage for disability and illness than they would with commercial pension companies and public welfare,” she says.

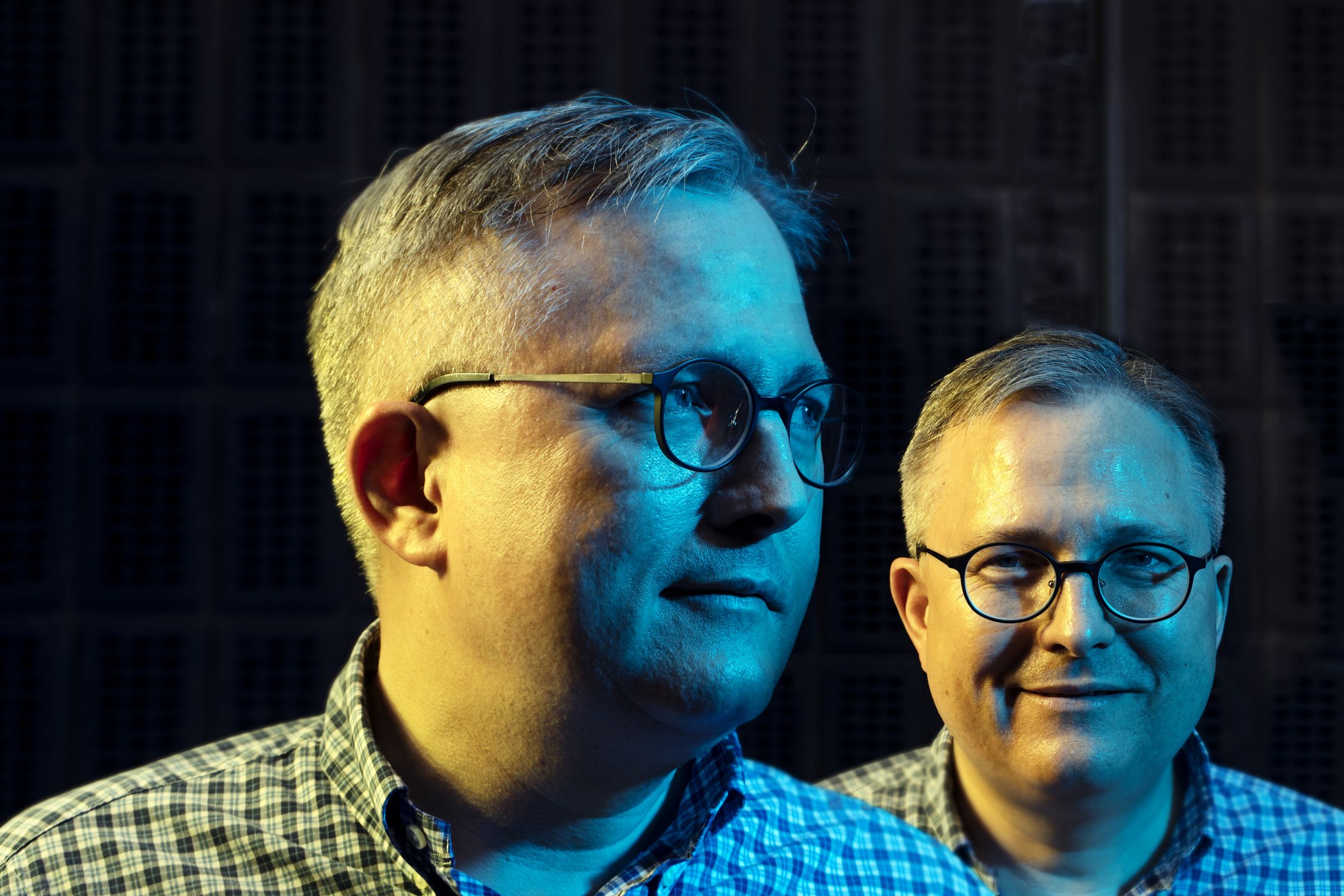

I don’t think DJØF is responsible for deciding how the money is invested

Sara Vergo, DJØF

At DJØF, Sara Vergo Deputy Chairman is afraid that a free market would result in competition for members, which is ultimately undesirable, she argues. However, she acknowledges that times may change.

“By ensuring that members have their pensions at JØP, we make sure that our members’ pension savings are not commercially utilized. However, in step with increasing individualization, people may want to choose pension companies themselves, and this is something we would have to discuss when that time comes,” she says and continues:

“We already spend a lot of time discussing sustainability and other issues concerning responsibility and our investments. And we listen to our members – their wishes and needs – as we intend to develop and adapt our products in sync with our members, who are also our owners.”

We also asked HK Stat to participate in an interview, but the union for office workers, lab technicians and IT staff, declined.

“It’s not our responsibility”

Djøf and DM both use member-owned pension companies, JØP and MP Pension, respectively, and argue that the members of the pension companies should speak their minds about investment strategies at general assemblies, and elect members who share their opinions onto the boards.

“As the pension company is owned by its members, the members should decide how their money is invested. However, it’s important to say that the level of returns is a crucial factor, because the pension companies are created to secure high returns, and at the same time JØP acts as a responsible investor. This means that we can’t sell off oil from one day to another. We have to critically assess how it will affect the returns,” says Sara Vergo, who represents DJØF in JØP’s board of directors and continues:

“I don’t think DJØF is responsible for deciding how the money is invested, that’s up to JØP and its members.”

In the end, we must constantly consider what’s the best strategy, and sometimes figuring that out takes time

Sara Vergo, DJØF

Camilla Gregersen argues that members who prioritize sustainability should actively engage in investment strategies when they are debated at general assemblies.

“It’s worth mentioning that MP Pension has just been named the most progressive pension fund in Denmark in a major study by WWF. This was the result of a considerable effort on the part of its members over a number of years,” she says.

For example, the members’ engagement in the investment strategy led to MP Pension canning all stocks in oil, coal and oil sands a couple of years ago.

Sustainability and responsibility on the agenda

Kommunikation og Sprog offers its members a pension scheme at PFA Pension. This isn’t a member-owned pension company like MP Pension and JØP, and according to Per Lindegaard Hjorth, it has been selected based on several factors. For example, returns on investments, costs, the option of a health insurance scheme, the insurance scheme that is part of the pension scheme, sustainability and responsibility.

“Sustainability is one of several factors that are all relevant. PFA has an agreement with Kommunikation og Sprog, which, in our opinion, has a strong focus on responsible investments and – consequently – sustainability. Kommunikation og Sprog is part of PFA’s Customer Council (Kunderåd), which discusses sustainability and other issues,” he explains.

Sara Vergo from DJØF says that with different members come different opinions. Many young members are very concerned about how their pension savings are invested, while some older members care less provided their returns are high. However, different topics within the themes of sustainability and responsibility are being discussed and it takes time.

“Right now, we are discussing questions related to tobacco. There are no conventions against investing in tobacco, and there is no legislation either. So, it’s a tough discussion, and it would probably be the same if the debate involved sugar or pesticides. In the end, we must constantly consider what’s the best strategy, and sometimes figuring that out takes time,” she says.

Comments