CBS PhD Fellow answers billion-dollar question: Can financial crises be predicted?

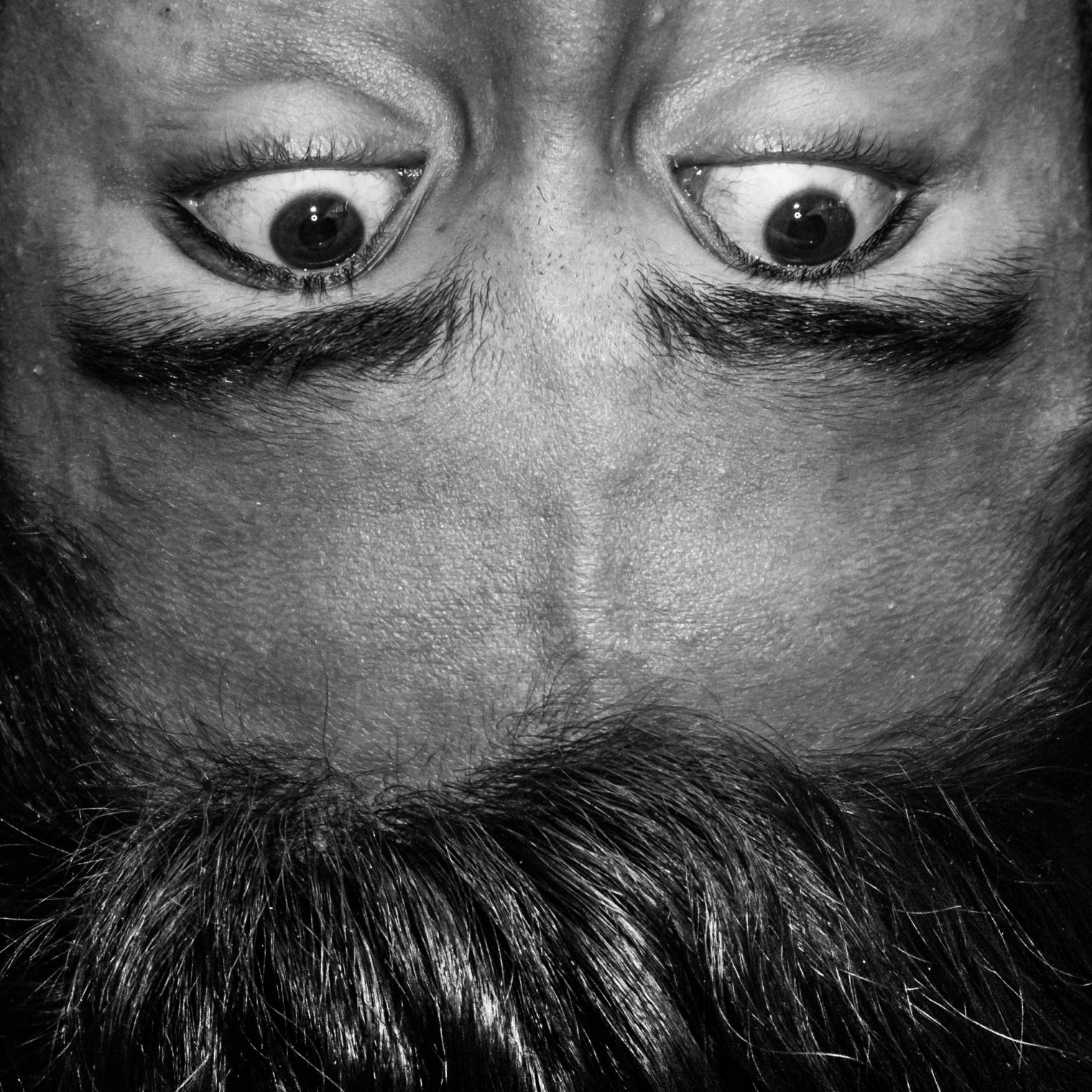

Jakob Ahm Sørensen is about to finish his PhD at CBS, and he has just published a scientific article which gives important insights into financial crises. (Photo: Anne Thora Lykkegaard)

The idea occurred to him during a run in the grounds of Harvard Business School, and when the data showed a more than convincing result, Jakob Ahm Sørensen knew he was on to something. The PhD Fellow at CBS tells the story of being a bachelor’s student wanting to understand the financial meltdown of 2008 to answer a crucial question about crisis predictability.

“The financial crisis of 2008 had a huge impact on so many people’s lives, and back then I really wanted to understand what dynamics and mechanisms burst the bubble. So, naturally, I applied for a Bachelor’s in Business Administration and Mathematics at CBS,” explains Jakob Ahm Sørensen.

That was in 2010. Now, he is sitting in his office at the Department of Finance at Solbjerg Plads and in the closing stages of finalizing his PhD. And somehow the thoughts and questions about the financial crisis he had as a young bachelor’s student ended up shaping his PhD studies.

“I guess you can call it a full circle,” he smiles.

Together with Professor Robin Greenwood, Professor Samuel G. Hanson, and Professor Andrei Shleifer from Harvard Business School and University, he has just published a scientific paper that refutes the view that financial crises are unpredictable bolts from the blue.

“Financial crises are predictable, and although other researchers have claimed so previously, our research is based on more data and comes with higher predictability. It’s not a perfect predictability, but it is high enough for politicians and central banks to use and act on the knowledge,” says Jakob Ahm Sørensen.

In short, the scientific paper shows that if credit and asset prices grow, the probability of a financial crisis during the next three years is roughly 40%.

For example, if there is an increase in companies’ debt and stock prices, combined with increased debt and housing prices for households, the possibility of a financial crisis is imminent.

And it is the combination of data from companies and households that makes the paper’s conclusions stronger than previous articles pointing towards the same tendency, he explains, adding:

“We know from previous financial crises that failing to predict them is awfully expensive. However, we don’t know how much it would cost to intervene in the economy when a financial crisis it not imminent,” says Jakob Ahm Sørensen.

Nobel Prize winners ignited an idea

In 2010, when Jakob Ahm Sørensen began his studies at CBS, he did not imagine an academic career could be an option for him. However, that changed after his bachelor’s when he did a one-year master’s at the University of Chicago in 2013. Just that year, two professors from the university won the Nobel Prize in Economics.

“One of the researchers won the Nobel Prize for a beautiful and very vigorous theory. The Efficient Market Hypothesis, which states that share prices reflect all information, and that the market can incorporate all information. I wanted to understand the implications of the theory better and decided that I wanted to become a research assistant. So that ignited my interest in doing a PhD,” he explains.

After his stay in Chicago, he enrolled in the MSc in Business Administration and Mathematics at CBS and became a research assistant. During this time at the Department of Finance, he was occupied with discrepancies in interest rate parity. (See fact box)

While working as a research assistant, Jakob Ahm Sørensen became convinced that he wanted to apply for a PhD and did so with the aim of continuing a project on discrepancies in interest rate parity. But as always with plans – they are made to be changed.

The Holy Grail of finance

One part of studying for a PhD involves taking a semester abroad. And for Jakob Ahm Sørensen it was evident that it had to be in the U.S.

Through his supervisor at CBS, Professor Lasse Heje Pedersen, he contacted Professor Robin Greenwood at Harvard Business School about a research stay.

“In some ways, I felt like Harry Potter, coming to this famous old university in Boston,” says Jakob Ahm Sørensen about being enrolled.

He explains that at Harvard Business School, the researchers are especially knowledgeable in the field of behavioral finance. For example, how people’s expectations affect price setting, and how people’s mistakes can affect financial outcomes.

“I wanted to know more about this, so I reached out to Robin Greenwood and his colleague Andrei Shleifer, who are leading lights in this field,” he says.

Jakob Ahm Sørensen and Andrei Shleifer began taking weekly jogs around the Harvard Business School campus while they chatted about this and that – and research questions.

“On one of our runs, we started talking about the predictability of financial crises and why the evidence of predictability was so limited. When we got back from the run, I started looking into what data was available about previous financial crises and how we could put together an analysis. Was it just a foolish idea, or can financial crises actually be predicted?” he says and continues:

“The first time I looked through the results of the predictability analysis, I thought to myself that it was quite crazy. I couldn’t wait to show my co-authors the results, as they were quite significant. We had just asked an open question, which we could answer convincingly.”

Robin Greenwood and Samuel G. Hanson joined Jakob Ahm Sørensen and Andrei Shleifer in writing their scientific paper, which has just been published in one of the top journals in their field – The Journal of Finance.

“Our paper contributes new knowledge and a new approach to financial crises. And in these times of incredible growth in housing and stock prices, it’s important to understand the dynamics that can drive a potential financial crisis, as the consequences for society are enormous,” he says and continues:

“And that’s why I like finance as a subject. It relates to society in so many ways, which is why it is important to research.”

Financial gamblers

The paper has whetted Jakob Ahm Sørensen’s appetite for more research related to financial crises and their predictability.

For example, he has a hypothesis that the financial system has ‘agents’ who systematically make mistakes that drive the so-called boom-burst cycles.

“Right now, I’m interested in whether investors make predictable mistakes in the time before a financial crisis. Who buys keeps buying stocks with blinkers on although the economy is booming and the expected compensation for risk is low? That’s interesting to know, as you can use that knowledge to regulate the market and its agents to avoid a financial crisis,” he says.

Comments