Are we all con artists?

The disclosure of several cases of white-collar crime worth millions and billions of Danish kroner marked 2018 as the year of fraud and greed. But what makes us commit large-scale fraud, or fiddle our income tax? CBS WIRE asked two researchers who say that it’s a basic human phenomenon that is unlikely to go away.

The Danish Language Council awarded ‘money laundering’ as the word that best characterizes 2018, in light of the potential money laundering of DKK 1,500 billion at an Estonian branch of Danske Bank, which was the ultimate talk of the town in 2018.

“It’s a dreary word, as it means that the social contract where we trust each other, expect to tell the truth, and don’t con each other, has suffered in recent years,” says Sabine Kirchmeier from the Danish Language Council about the word of the year.

In total, 10 words were nominated for the award, along with ‘fraud’ and ‘thieves in suits’ making an appearance too. Understandably, unfortunately.

Besides the money laundering case, collaboration between a number of European news media outlets revealed that a network of banks, stock traders and top lawyers had obtained hundreds of billions of kroner from the European treasuries through suspected fraud and speculation with dividend tax. Denmark was defrauded of DKK 12.7 billion.

And then Britta Nielsen’s name was on everyone’s lips. Over a period of 16 years, Britta Nielsen, who worked for the National Board of Social Services, had transferred a total of DKK 111 million from the board’s bank account. Money that should have been spent on social projects.

Furthermore, 2018 marked the 10-year anniversary of the collapse of the tech company IT Factory, where CEO, Stein Bagger pleaded guilty of fraud to the tune of DKK 831 million.

But why do we commit large-scale financial fraud or tamper with the parking disc to avoid getting a parking ticket? And can we as a society stop all this scamming once and for all?

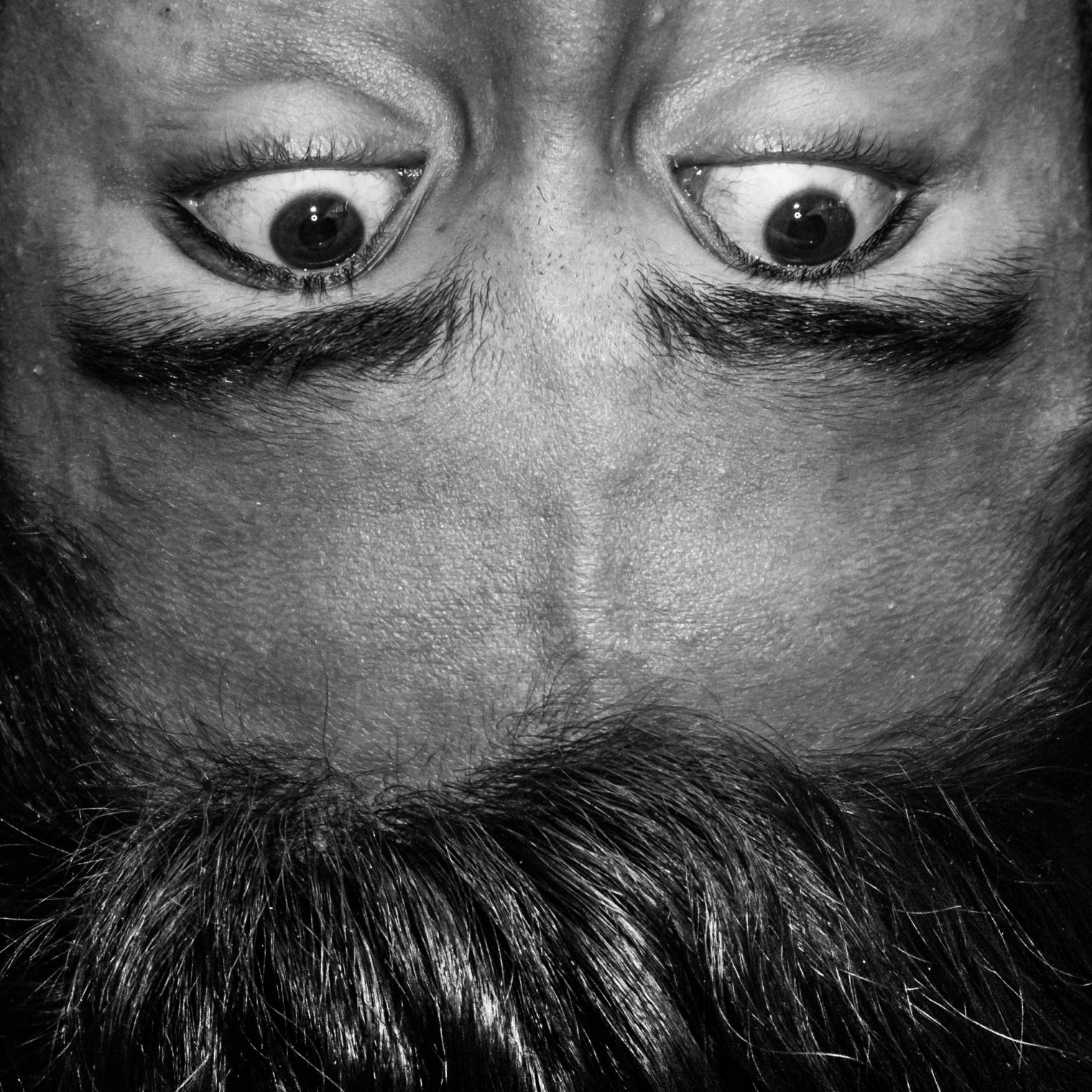

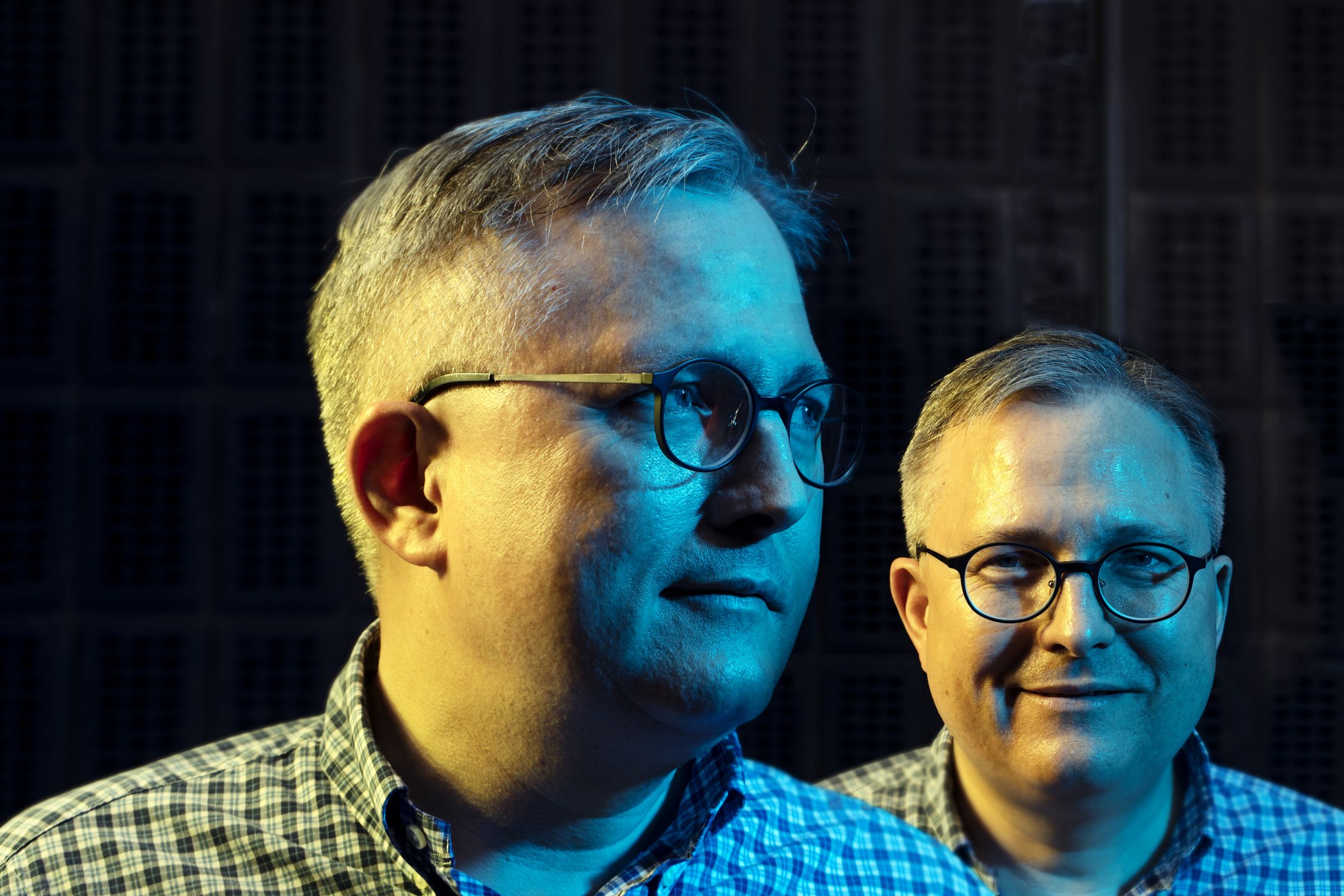

CBS WIRE discussed this with Assistant Professor in Applied Business Philosophy, Thomas Presskorn-Thygesen from the Department of Management, Politics and Philosophy, and Associate Professor in CSR, Steen Vallentin from the Department of Management, Society and Communication at CBS.

Fraudulent and moral infringements

Thomas Presskorn-Thygesen starts out by suggesting that the many varieties of fraud from everyday ‘white liesø to large-scale Ponzi schemes stem from the fact that the capacity to be conned and defrauded is quite human:

“Aristotle classically argued that it is our unique capacity for language and reasoning that sets us off from the rest of the animal kingdom. However, as the contemporary philosopher Tim Maudlin has quipped, humans seem to be equally unique in our capacity to be conned and defrauded. To quote Maudlin, humans are “duped by liars and conned by frauds; manipulated by rhetoric and beguiled by self-regard” like no other animal. This seems contradictory, but when you reflect upon it, it’s not. It is because of our capacity for language that we are especially prone to be deceived, swindled and scammed,” says Thomas Presskorn-Thygesen and continues:

“In this sense, fraud is a universal human phenomenon occurring on many levels – from tampering with the parking disc to avoid getting a parking ticket, the extra-marital affairs and scandals such as the recent CumEx case.” (See fact box.)

Before the interview, Steen Vallentin makes it clear that fraud isn’t something we all commit. To him, you’re not a con artist if you do a bit of fare-dodging on the metro, or cheat your insurance company.

“In my view, fraud does not encompass every kind of moral infringement, such as fiddling your income tax or making a false report to the insurance company. So in my opinion, we’re not all con artists,” he says and gives an example:

“The previous Mayor of Culture and Leisure in Copenhagen, Niko Grünfeld, is not a con artist, he ‘just’ lied about his résumé. Stein Bagger, on the other hand, is a con artist. He was cunning and knew that he wanted to commit fraud. And that’s the difference. It’s not just about cutting corners,” he says and continues:

“Most of us don’t even have the opportunity to commit fraud, and we’re not all sociopaths. People like Britta Nielsen and Stein Bagger were close to money, and they couldn’t resist the temptation. But they knew they were living on borrowed time.”

When trust is betrayed

Any kind of fraud – if revealed – is a blow to our trust. When our trust is abused, we’re left with the feeling of betrayal. But it’s trust that makes fraud possible.

“Many instances of financial fraud stem from the fact that trusted employees are left unchecked. Trust therefore provides an opportunity for the con artist to cheat, often in pursuit of self-interest and at the expense of the trusting community,” says Thomas Presskorn-Thygesen and continues:

“Fraud is even destructive beyond its immediate economic cost because it corrodes trust. Trust takes years to build, but it can be destroyed in an instant.”

Britta Nielsen is a great example of this. She was employed at the National Board of Social Services. A national institution that spends taxpayers’ money on projects to benefit the socially deprived. Her wrongdoing not only affected her workplace, it affected all working people in Denmark who pay tax, as they lost their trust in the board’s ability to check how their money was being spent.

“We live in a high-trust society and are among the least corrupt countries in the world. We expect people to behave themselves and avoid any wrongdoing. But maybe this is our society’s weakness, and our society is not as strong as we like to think,” says Steen Vallentin.

Britta Nielsen’s case was a hard knock to the Danish welfare state. However, the CumEx scandal was an even greater blow to the idea of a welfare state, argues Steen Vallentin.

“The CumEx scandal is pure madness. I mean, what’s the logic behind stock lending? It has to be opaque. And the worst thing about this case is that it has been done with open eyes. It is aggressive tax planning on the edge of the law. And there are only a few things more damaging to the welfare state,” he says and continues:

“These people have been lulled by the idea that what they’re doing is okay, as long as they don’t harm anyone – directly.”

Thank the internet for large-scale financial fraud

Before we had a thing called the internet and super-advanced algorithms to do calculations for us, fraud was simpler – analogue in a way. Fraud was taking money from the cashier, cashing a fake check at the bank, or defrauding someone’s mother. Today, fraud is much more complex and far reaching, and we can thank the fast development of modern technology for that.

Thomas Presskorn-Thygesen points out that the CumEx scandal is a very good example of this:

“The CumEx scandal is not just a moral challenge for contemporary societies – a question of how to deal with a kind of ‘moral bankruptcy’ within high-risk banking and investment. It is also a technological challenge, for this scandal, like so many others, relies on an intricate web of modern technology, complicated routes of trading and advanced legal rules. In short, technology will continue to push the policy debate on fraud, since technology simultaneously multiplies the risk of fraud and offers us new ways of combatting it,” he says.

Furthermore, modern technology makes it easier to commit fraud because con artists don’t have to look their victims in the eye.

“They don’t stand face-to-face with Mr. and Mrs. Smith when it happens. So in that sense, technology makes it easier and less of a moral burden,” says Steen Vallentin.

Fraud calls for control – but how much?

The new types of financial fraud are pressing politicians and decision makers to come up with ways of avoiding and eliminating fraud. This is, however, no easy task, since they are confronted by a dilemma, explains Thomas Presskorn-Thygesen.

“On one hand, it would seem both desirable and possible to eliminate all kinds of fraud by means of more control. To use a simple example, it might be perfectly possible for a supermarket to eliminate all shoplifting by imposing strict control over all customers as well as employees. On the other hand, such control measures may not be desirable at all,” he argues and continues:

“Firstly, some control mechanisms are likely to be inefficient in economic terms. Implementing, say, airport style controls at a super market would not only be an annoying hassle; it would be massively inefficient if measured by its economic cost. Secondly, a society without fraud would mean a massively controlled society. The possibility of fraud, one might say, is something that we have to endure, if we want to live in an open society and if we want to work in organizations characterized by basic trust.”

Most of us don’t even have the opportunity to commit fraud, and we’re not all sociopaths.

Steen Vallentin

When the money laundering case at Danske Bank was at its highest, CBS decided to put a stop to new collaboration with the bank. The President of CBS, Per Holten-Andersen said to CBS WIRE in September 2018 that the management of Danske Bank, “is not a role model to our students” and “we want our students to take responsibility for the work they do in their organizations when they enter the job market and do it in a broad societal perspective.”

So is giving business school students the right set of values to make them responsible business leaders and managers the right way to avoid future cases of money laundering and financial fraud?

“We have created a financial system with perverted incitements. The system is broken so to speak. It’s difficult to find a solution to this, and it can’t be fixed by giving business students the ‘right’ set of values because, after all, what are the ‘right’ set of values?” asks Steen Vallentin and continues:

“Of course, we can give the bad guys large fines, but these penalties are often just a drop in the ocean in terms of their wealth.”

Fraud is simply something we will have to live with some way or another.

Comments