Criticized company form dispensed with: “Now, only children with rich parents can afford to start businesses”

At Entrepreneurial Day students showcase their start-ups, however, with the entrepreneur company form being dispensed with, fewer students may take the chance and start a business, a CBS professor and the chair of Danish Entrepreneurs conclude. (Photo: Anne Thora Lykkegaard)

Irregular political moved and bad publicity have been the downfall of the entrepreneur company form, and on November 15, 5,500 businesses risk facing a compulsory dissolution, according to CBS professor Troels Michael Lilja. Along with Danish researchers in company law, he advised against the decision, which has resulted in Denmark having the second-highest capital adequacy requirement in the EU. The Chair of Danish Entrepreneurs says that entrepreneurs are left in a no man’s land.

Since 2014, according to Danish capital adequacy legislation, entrepreneurs have only needed DKK 1 in the bank to start a business in Denmark. But this year on October 15, the company form known as the entrepreneur company (Iværksætterselskab – IVS) was abolished.

The process leading up to the political agreement to terminate the company form has been characterized by irregular political moves, revealing tweets, and a negative discourse without foundation, explains Troels Michael Lilja, Associate Professor in company law at CBS LAW.

He has followed the political discussion, read a ministerial report about issues related to IVS companies and along with other researchers in company law, tried to reverse the decision through responses to a hearing request on the law that made it possible to abolish the company form.

“As researchers hired by the Danish universities, it is our duty to bring our research into play for politicians and society at large. In relation to legislative procedures, we can involve our research to recommend which way to go,” says Troels Michael Lilja and continues:

“In the case of the entrepreneur companies, politicians said that there were problems with fraud, but if you looked into it, that claim was unfounded.”

November 15 is the final deadline for the existing IVS companies to re-register as private limited companies, otherwise they will be compulsorily dissolved.

“Last time I checked, about 5,500 companies are going to be dissolved in medio-November,” says Troels Michael Lilja, who expects that fewer people will consider starting a business as a consequence.

“My guess is that with the termination of this company form, we will see fewer entrepreneurs and an increase in the wage earner culture. It’s not necessarily a problem to have a strong wage earner culture, but we need entrepreneurs to ensure continuous growth,” Troels Michael Lilja says about the decision.

Peter Kofler, Chair of the organization Danish Entrepreneurs, says that the decision leaves current and future entrepreneurs in a “no man’s land”.

“Confidence in the system has been shaken. We were told to start businesses and were offered the IVS form, now a lot of businesses are trapped in legal crossfire where they have to re-register their businesses, or get trapped in a no man’s land,” he says.

The capital adequacy requirement of DKK 40,000 makes no sense, and it does not make the company more secure in that respect

Troels Michael Lilja

From his point of view, Denmark and the world need more entrepreneurs. Not fewer. And to get more people to start a business, you need political willingness and opportunities.

“We need entrepreneurs. Right now, our world is facing challenges of immense proportions. We need green entrepreneurs, tech entrepreneurs and to explore and experiment in general. And this move will make that a lot harder now,” he says.

First came England, then Germany and Denmark

The whole story about the establishment and later termination of the IVS company form began in Northern Zealand in 1999.

A Danish couple had started a private limited company (Aps) with an initial capital of DKK 80,000 but was asked to have DKK 200,000 in capital adequacy requirements (kapitalkrav). The couple knew that they did not need that much money to start their business, so instead they closed it down and founded a company for the cost of only one pound in England. Through the English company, they could open a Danish branch of the business, to avoid the Danish capital adequacy requirements, explains Troels Michael Lilja.

“At that time, the Danish Business Authorities said that it was an illegal bypassing of the Danish rules for capital adequacy requirements. The case ended up in the Court of Justice of the European Union, which concluded that the couple had the right to found a company in another country and start a branch in Denmark,” he says.

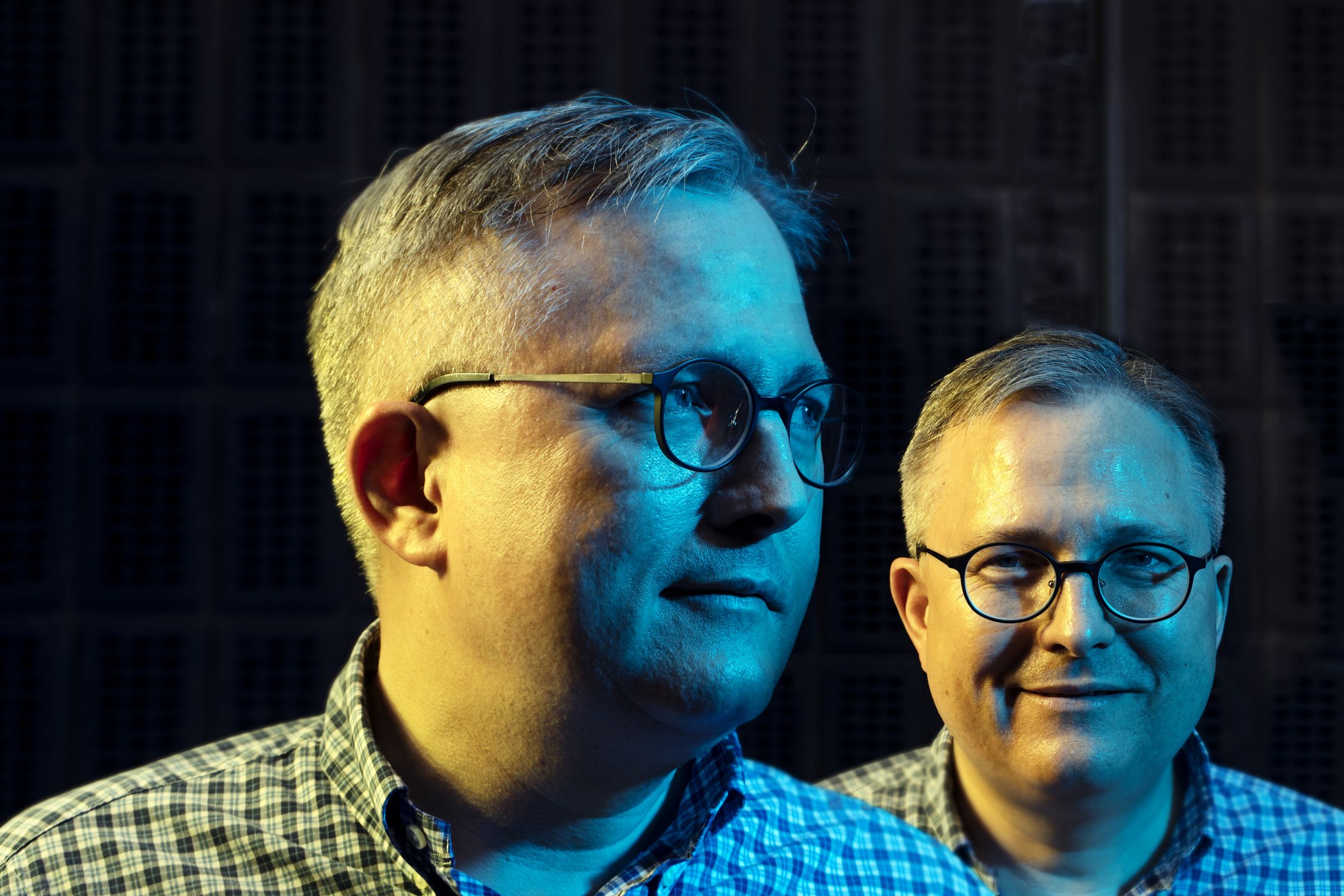

At CBS Entrepreneurial Day, students get the chance to showcase their start-up. A recent political ruling could possibly keep students from starting a business, fears the Chair of Danish Entrepreneurs. (Photo: Anne Thora Lykkegaard)

The ruling did not initially result in a change in practices in Denmark. But the German and Norwegian authorities noticed that a lot of entrepreneurs were starting businesses in England, Troels Michael Lilja continues.

“Germany realized that this was bad, so they made it possible to start a business with a capital adequacy requirement of EUR 1. Denmark then followed Germany’s example and revised the company law to make it possible to found entrepreneur companies with a capital adequacy requirement of DKK 1.”

But shortly after the establishment of the company form in 2014, the discourse took a negative turn.

The problem is not the entrepreneur company – the problem is the taxi law

According to Troels Michael Lilja, it started with The Association of Certified Public Accountants (FSR) which criticized the company form for having no audit obligation. And with no audit obligation – no money for the audit professionals. And then the negative stories started rolling in the media.

“A huge story about VAT carousel fraud hit the news. A total of 11 companies were involved, three of them were entrepreneur companies, which gave them a bad reputation, even though eight of the companies involved – the vast majority – were not entrepreneur companies. This was topped off with the numerous taxi cases,” he says.

We keep saying that it is okay to fail, but with the abolition of this company form, that’s no longer the case

Peter Kofler

The term ‘taxi cases’ refers to a number of cases where taxicab owners founded hundreds of entrepreneur companies for DKK 1, to apply for taxi licenses. Troels Michael Lilja explains that the taxi law states that you can only apply for a taxi license if you have a CVR number. So the more companies you have, the bigger the chance of getting a coveted taxi license.

“Maybe a taxicab owner would have 100 IVS companies, but only get licenses for three of them. He would then close the remaining 97 companies. Some viewed this as fraud. But the issue here was not the company form. The issue was the taxi law. If the politicians looked at the taxi law, they could change it to be based on, for example, addresses or haulers and not CVR numbers,” he says.

After a lot of bad publicity and cases in the media, the Ministry of Trade ordered the Danish Business Authorities to make a report scrutinizing the company form.

A sham hearing

The report was published in September 2018 and concluded that the issues with fraud among the entrepreneur companies were no bigger than other types of company forms.

“As the report says, the IVS companies have a lower compliance rate, however, this does not mean they are more criminal. If you ask the business authorities, the lower compliance rate covers the fact that the business owners have not sent their annual reports to the authorities in time or failed. To register their real owners. This, I believe, is more a matter of the people starting the businesses not quite knowing what it takes,” says Troels Michael Lilja.

Around the time the report was published, the government was in dialogue with the Danish People’s Party about a possible abolition of the company form, explains Troels Michael Lilja.

“The law reform went out to consultation at the end of January 2019, and this was when I joined other researchers in company law and signed a response arguing that abolition was the wrong approach, based on our research. We recommended that the politicians put the company form on hold and further investigated the problems with the IVS companies before deciding on their fate,” he says and continues:

“However, the response was in vain. The Minister for Trade, Rasmus Jarlov, wrote a tweet stating that we should have shared this information in the autumn, indicating that the deal with the Danish People’s Party had already been made back then, making the hearing request a sham.”

Will we miss out on the next Just Eat?

Now, the capital adequacy requirement is DKK 40,000 for starting a business, placing Denmark in second place above countries in the EU with the highest capital adequacy requirements. Slovenia takes first place with DKK 56,250.

Together with several interest groups and organizations, such as Danish Entrepreneurs and The Danish Chamber of Commerce, Troels Michael Lilja has proposed a lower capital adequacy requirement.

“The capital adequacy requirement of DKK 40,000 makes no sense, and it does not make the company more secure in that respect. A CEO can just have the money paid out as salary the day after the business is established,” he says and suggests that the politicians lower the capital adequacy requirement to the Danish ApS, and invest more money in control.

“Can’t we afford to set aside resources for control with these companies, instead of losing out on the next Just Eat?”

Instead the capital adequacy requirement should be DKK 8,000.

“DKK 8,000 is the EU average, and it would be a good compromise and easy for the Social Democrats to swallow. However, we have a Minister for Industry, Business and Financial Affairs who time and again postpones discussions about entrepreneurship,” says Peter Kofler.

All in all, Peter Kofler concludes that the company form has meant a great deal for the entrepreneurial environment in Denmark.

“The company form has meant that a study group could realize their bachelor project, that more women have dared to start businesses, and that we have seen a far more diverse range of start-ups within all sectors. We keep saying that it is okay to fail, but with the abolition of this company form, that’s no longer the case,” he says and warns:

“Now, only children with rich parents can afford to start businesses.”

Comments