5 habits I have with money that you shouldn’t have

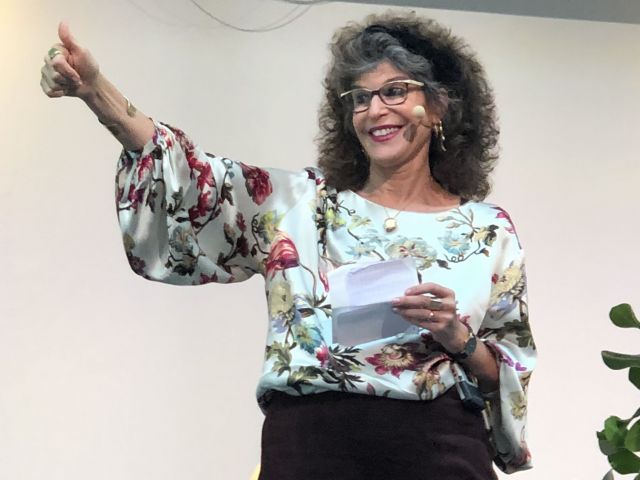

(Illustration by Carla Altes Mas)

I’m terrible with money.

Not because I don’t know how to spend it, but because I definitely know how to spend it.

I have a mental list of things that I’d like to buy, all the time. Throughout my whole life, every time I need to make a decision about a purchase, I’ve been telling myself “You don’t need to save now, you’re too young!” as some excuse to indulge in whatever it is that I feel like at that moment.

But oops… time is starting to be over now. Being 22 with too many dreams of travelling, studying abroad and a huge wish to move out of my parents’ house as soon as possible (yes, guys, it is normal to still live with mom and dad at 22 in Latin American countries, don’t be horrified) means that I should definitely stop spending so much and start saving.

I’ll give you a bit of a background: I’m a student on a good salary but still not amazing, living my life like I’m Beyonce

I’ll give you a bit of a background: I’m a student on a good salary but still not amazing, living my life like I’m Beyonce.

It’s like deep down my inner diva cannot shut up every time I go near a shop, “Buy two of these! If you’re buying a shirt, you also need pants and shoes! You should get another candle to match the other 30 you already have!”. I find perfect excuses for needless purchases, and I buy 3 of everything just in case.

Is it an issue? Should I check some therapist about this? I’ve often thought that I would one day end up like those ladies in the TV shows where they throw some sort of intervention for them because their credit card bills have been unpaid for ages and they are about to be homeless. But I’m also a very responsible person who works like crazy and knows when to stop. I still haven’t gone crazy and booked a vacation to Thailand or bought a designer bag all of a sudden, although maybe someday…

It’s like deep down my inner diva cannot shut up every time I go near a shop

As the very analytical person I am, I have identified and grouped my behaviors so you can avoid them as well. So, here are my 5 habits that I have with money that you shouldn’t have:

I see it… I like it… I want it… I got it:

So the process goes like this: I fall in love with whatever ad I see online (such as a sleep mask that shows you blue light so you can have better dreams, or a spinning top — like the one in Inception — that is completely needless and costs 100 euros, but is also kind of cute), I try to convince myself that I really shouldn’t buy that and it won’t add any value to my life, but somehow, I end up buying it anyway. For any marketing or advertising majors, I’m the best person to run ads on, so you can definitely interview me.

Is it expensive? Okay, I’ll take it:

I have a great eye for always choosing the most expensive thing. Whether it’s food or clothes or decor, every time I’m at a shop and I say “Oh, what a nice thing!” I bet you it’s gonna be the most expensive one in the place. I have very particular tastes: I only eat organic bread (which is common for Denmark but not at all for Argentina) or go to a certain fancy gym, I drink Japanese green tea instead of coffee, I can only sleep with a lavender-scented pillow that needs to be changed often. Yes, I understand all these things make me sound like a monster, but I promise I’m not as bad as I sound.

It’s Christmas every day for everyone:

Oh, I love giving gifts to others at random times! It’s not only birthdays and anniversaries, and they’re usually pricey gifts. My policy for gifts is usually to give to others stuff that I would use myself, so they’re never going to be bad or cheap things — which is great for a rich CEO, but definitely not for a girl on a student-job salary.

I’ll pay for the first, second, third, fourth date…:

I usually put an emphasis on how I’m an independent girl who can pay for her own stuff, but it has become a bit of an issue. Now, every time I start dating someone, I end up paying for everything. Maybe I am dating the wrong people (and I definitely am), but I end up becoming the “breadwinner” in the relationship. I used to complain a lot about a certain guy I was seeing who NEVER spent a penny in the relationship, but I did realize that it was my fault, it was me insisting on the fact that “Don’t worry, I got the bill”.

Saving? What’s that?:

Has anyone ever seen that episode of Sex and The City where Carrie (the main lady) needs to buy her apartment but only has, at 40 years old, 400 dollars in savings because she spends all her money on shoes? That one really got my attention. I do fear that I might become one of those people, and not because I’m lazy and don’t earn my own money (because I love my job and love working), but because I spend it all on useless things.

I might not be 40 and as irresponsible as Carrie, but I definitely need to start being smarter [about/on] my expenses and save more. So, no more clothes shopping because “I think I’m sad”, going to the expensive food place twice a day, or buying random things online at 3AM. On my next dates, I’ll split the check, and no more expensive gifts for my mom and my best friend… at least, until I become the successful CEO I know I’ll be.

(Illustration by Carla altes Mas)

Comments