24 researchers trawl through scandal-hit financial sector and give advice for the future

Blurred lines between sales and financial counselling, discussions about digital currencies and money laundering cases – these are some of the aspects a new report investigates with the core aim of clarifying and recommending solutions to the future challenges faced by the financial sector.

After four years of intense work, the Nordic Finance and the Good Society research project (NFGS) has just published a report containing ten recommendations for the financial sector in order to fight disruption caused by the digitization, blurred lines between what are perceived as sales and counselling and, not least, money laundering.

The team behind the research project includes 14 researchers from CBS and a range of professors and researchers from various universities and institutes in Denmark, Germany and Switzerland.

The project was initiated and conducted by the Center for Corporate Governance at CBS, and although phase one of the NFGS has only just finished, they are already on the verge of moving on to phase two.

(Photo by Mette Koors)

A new set of values

Phase one, however, began before the money laundering scandals and discussions on digital currencies saw the light of day.

Back then, the main goal was to analyze new strategic perspectives and trends within the financial sector, and identify opportunities and challenges the financial sector might experience in the future.

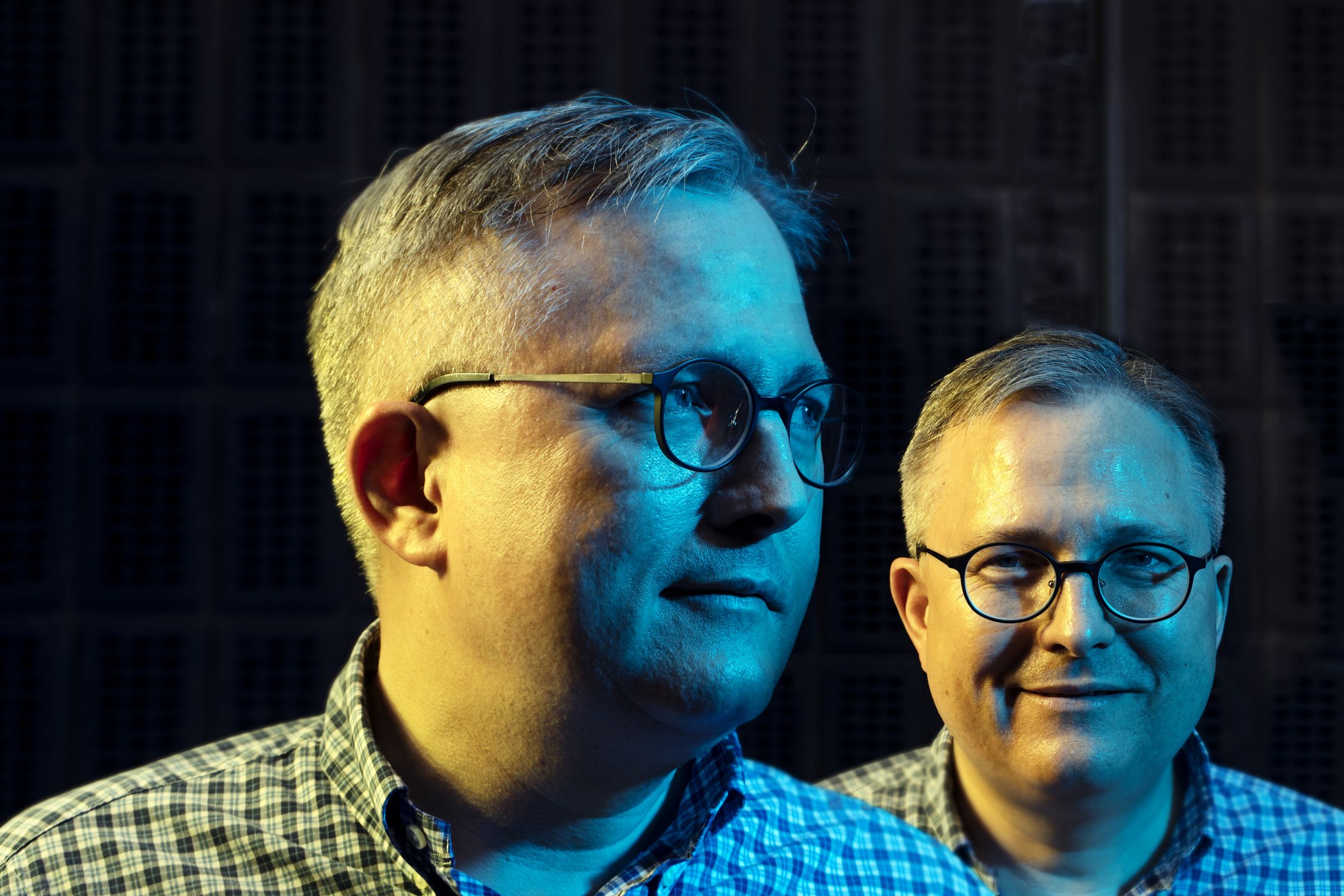

And according to Lars Ohnemus, Director of the Center for Corporate Governance, this could only be realized through a thorough and broad investigation of the financial sector.

“If you want to take a look at the future of the financial sector, it’s important to understand all the parameters of this area,” he says.

This means understanding parameters such as digitization, economical regulations, business models, funding of capital and so forth that all have independent and interconnected impacts on how the sector operates, including potential future trends.

“To do this, we collected 24 researchers from different institutes and universities with different academic backgrounds who subsequently analyzed and discussed all the different aspects of the sector. And this proved to be a unique and interesting way to work,” he says.

The findings revealed by the 24 researchers have been gathered and summarized as ten conclusions and recommendations.

And one of the most essential conclusions is that the financial sector needs a whole new set of values that everyone within the sector can agree on.

“One of the most important objectives of the project is to create a set of values in the financial sector that can’t be rejected,” Lars Ohnemus says.

“In the Nordic countries, we’ve always emphasized good corporate governance, and if the financial sector wants to fight current and future challenges and restore public trust – this is the place to start.”

In other words, fighting the challenges faced by the financial sector now and in the future requires a new set of rules, practices and values.

Money laundering and rapid developments

In terms of regaining public trust, several events happened during the first four years of research that were of great importance to the research team.

“In 2017-2018, the Danske Bank money laundering scandal hit the headlines, which was a heavy blow to the Nordic financial sector. It triggered a heated debate in the media and among the public on the subject of banking governance,” Lars Ohnemus explains and continues:

“This had a major impact on the project and will continue to do so for years to come.”

“Also, the discussion about digital currencies accelerated tremendously throughout the period. The question was no longer whether it would emerge, because suddenly it did. And then a new discussion began about who should administer this new digital economy,” he says.

Other fundamental problems about how the financial sector had been operating for years also had consequences during the period of research.

“For years, banks have been blurring the lines between financial counselling and sales. And this is a big problem because banks are supposed to be transparent and protect their clients’ interests,” Lars Ohnemus says and continues:

“One example of this is the Flexinvest Fri case, which involved Danske Bank advising 87,000 clients to buy the investment product Flexinvest Fri, while taking high fees and knowing that thousands of clients would receive negative investment returns.”

And as if money laundering, discussions about digital currencies and blurred lines were not enough, the financial sector is currently experiencing challenges with rapid developments in different areas.

“Right now, there’s a lot of disruption going on within the sector, where companies and banks are having trouble keeping up with rapid developments in areas such as digitization, declining interest rate margins and the everchanging investment environment,” says Lars Ohnemus.

“Therefore, there are numerous reasons why the future of the financial sector is an incredibly interesting research field to dive into.”

From phase one to phase two

These days, Lars Ohnemus and the rest of the new research team behind the NFGS project are adding the last pieces of the preparation puzzle to begin four more years of research in phase two. And here, the findings from phase one will be the basis for departure.

“In phase two, we’ll be studying money laundering in much more detail – how to avoid it and how to create a system that prevents it. The current anti-money laundering system is very heavy and ineffective, and unfortunately only a few criminals get caught,” Lars Ohnemus says and continues:

“Also, the question of which implications sustainable adjustments will have on future economies, as well as themes like digital currencies and future business models, will be analyzed and discussed.”

While the first phase of the project aimed to contribute to discussions on future strategies and business policies in both Danish and Nordic contexts, phase two aims to incorporate and unite the Nordic countries even more.

“Researching Denmark alone does not help us eradicate problems such as money laundering. Therefore, if we unite the Nordic countries, we will be better equipped to solve the problems faced by the financial sector.”

With all the banking scandals, money laundering and distrust, one might think that the financial sector has been totally demolished and needs a rebuild. But according to Lars Ohnemus, this is not the case.

“It’s a little harsh to say that the financial system has broken down and needs to be fixed from scratch,” he says.

“The financial sector is very important because it comprises around 6 percent of Denmark’s BNP and includes more than 60,000 employees in Denmark alone. And a lot of aspects work optimally. But when that’s said, the sector is currently experiencing a storm and will continue to do so.”

Now, the NFGS research team will begin working for four more years on phase two of the project. But for some, four years might seem a long time and prompts the question: when will the financial sector reach its ultimate set of values?

“Well, it definitely hasn’t yet. This journey has just begun, and creating the best possible value for individual citizens, companies and society will be a transition phase that will take five to ten years to achieve,” concludes Lars Ohnemus.

Comments